It's an intriguing time in monetary innovation.

We're operating in a distinct financial atmosphere. Money is low-cost, which has prompted a collection of mergers and procurements in banking, with smaller sized gamers combining to accomplish bigger scale. This enhancing rationalisation out there means banks require systems that can promote the scale of development that they're seeking to achieve.

Customers are calling the shots. As well as they uncommitted what's taking place in the back end. As Phillipou says, "It's banking advancement in front-end applications that they observe-- making it less complicated transact on the internet including to move cash, take out cash, obtain cash, get a bank card, make payments."

The important part is the engagement as well as interaction they are experiencing; just how straightforward is it to open up an account and also end up being a customer electronically. A financial institution's system requires to be able to automate processes and also give a frictionless experience for the consumer.

If a financial institution is seeking to change or readjust elements of its core financial system to address customer expectations as well as growth purposes, it's mosting likely to be a risk/benefit trade-off.

Right here is where the sixty-four-thousand-dollar questions come in, according to Phillipou. "Do they see the worth in investing hundreds of countless extra pounds doing a makeover of that gravity? Or, if their core system can still do the basics and also evolve through upgrades, should they be buying front-end applications that allow them to supercharge their growth and also please consumer expectations?" he says.

Analyzing systems

A core financial platform is the engine that drives the bank's main procedures, responsible for the opening and also maintenance of car loan as well as checking account, preserving the central document of transactions, interest and also more. It's the 'source of truth' for account standing and also account information which are accessed by other systems as well as feed consumer networks.

In addition to that system, organizations have account opening/origination systems which gather client data and also manage the application procedure by interacting with the core banking engine. As well as there are account maintenance systems that allow consumers and also inner users to inquire their account status as well as transact on their account.

Both additional systems may be provided by the core financial provider and also classed as part of the core financial engine, or they might be a separate system/product that is incorporated with the core financial engine.

Is there a third alternative?: Fintech providers like Sandstone Modern technology deal services that can be incorporated with the core financial engine after the truth. These fintech integrations are normally achieved by means of conventional APIs which help streamline the integration and permit a brand-new service provider to extra quickly weave the remedies seamlessly right into those of various other technology suppliers.

City of London at sundown as well as company network links principle image with lots of business symbols. Technology, transformation as well as development suggestion.

Threat, and why adjustment has been so slow-moving

Many core financial systems have remained in situ for many years, occasionally years. Big amounts of money as well as sources have been spent. Advantages aren't instantaneous, they're counted over years. " As soon as a bank has actually done its benchmarking and also chose to invest in a core financial system, they're committed for the longterm," Phillipou claims. "They will not be writing off that degree of investment quickly."

Include the truth that banks, by and large, are infamously very risk-averse organisations. They need to be conventional, due to the fact that they're custodians for individuals's cash. They need to see to it they have systems, procedures, and a danger hunger method that is in line with their customers' expectations, to make certain consumer confidence and data defense.

But as Phillipou clarifies, the best danger they are exposed to when migrating off an older data platform is execution risk. " To start with, these kinds of programs are complicated as well as prominent for running over routine which has massive effects for banks," he says. "What might present itself as a compelling proposal in the tendering process can, as soon as implemented, end up being an functional and costly headache for the financial institution."

Numerous CTO and CIOs obtain startled when they check out core financial improvements that have gone south, like Royal Financial Institution of Scotland, whose ill-fated software program upgrade in 2012 resulted in an interruption leaving millions of clients incapable to make or interacct business consulting receive settlements. RBS was fined 56 million extra pounds by British regulatory authorities in 2014.

When CTOs, CIOs as well as other choice manufacturers choose to alter their core systems, they need to win the hearts as well as minds of the board as well as the executive right throughout the organisation. It's frequently not an very easy sell.

Front-end integrations are the key to growth

Several institutions remain in the difficult placement of being beholden to ageing, monolithic core banking systems where modifications as well as updates to their systems are usually complex, time consuming and also costly. Transaction handling is crowded, loan processing is slow-moving and they might not have the capacity to interface into their front-end applications to the degree they 'd such as. The system can not do what they need it to do, to satisfy growth objectives and objectives.

Ultimately, development significantly comes through the banking applications that are customer encountering, Increasingly banks are identifying that new front-end applications will get a greater return on investment than a major core change.

Frontend remedies can involve revamping the entire customer-facing style, or simply making little calculated adjustments to procedures that influence the customer experience.

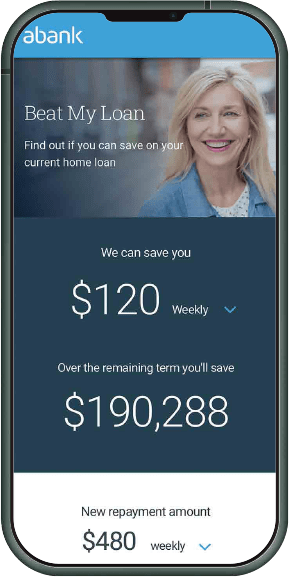

With smooth UX across electronic financial capacity via apps, "it's like opening up a home window to a shop" Phillipou claims, assisting financial institutions charge accounts promptly, onboard customers rapidly-- every one of those retail banking demands. It's constructing that digital value proposal which gives financial institutions the capacity to complete and win, making certain they're protecting existing clients, growing their consumer base and market share, in addition to enhancing credibility.

Quick, agile integrations with Sandstone Innovation

A financial assimilation specialist, Sandstone Modern technology can collaborate with any core banking system company. Implementation is fast - between 3 and year relying on the complexity of the deployment as well as the bank's internal processes.

Sandstone Innovation is a trusted electronic partner to tier 1-3 banks, constructing cultures, member neighborhood possessed banks and cooperative credit union with customers throughout Australia, New Zealand, Asia as well as the United Kingdom.